Our Services

Business Plan

Our expert market research-driven business plan helps you with competitor data, compliance, market insights and growth plan.

Learn More →

Financial Modelling

An expert cashflow planning to estimate fundraising needs, valuation metrics, equity dilution and exit plans.

Learn More →

Valuation Report

We help founders with projected valuation reports to help them understand the equity dilution for fundraising.

Learn More →

Strategy Consulting

We consult startup founders to explore, understand, and develop sustainable revenue streams and effectively raise funds.

Learn More →

Due Diligence

We deliver in-depth audits and reviews of financial records before entering into a proposed transaction with any startup.

Learn More →

Startup Advisory

We work closely with startup founders to make informed partnerships, strategic and investment decisions.

Learn More →NO GUESSWORK!

Business Plan

for Fundraising

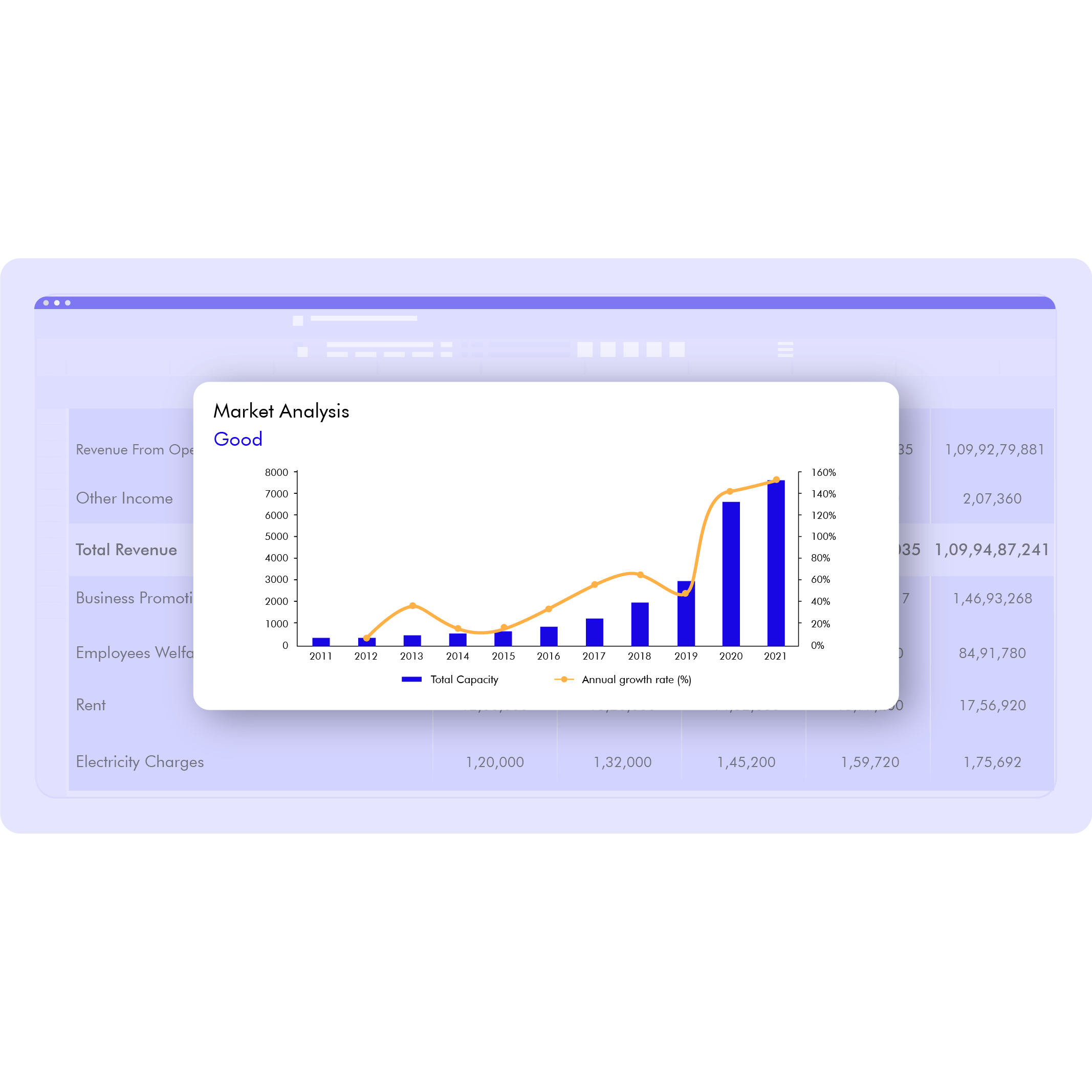

Market Analysis

Investment potential of a startup can be evaluated only from a research driven market analysis and business model. Our market experts will help you understand the product market bit, competition, market potential and startup feasibility.

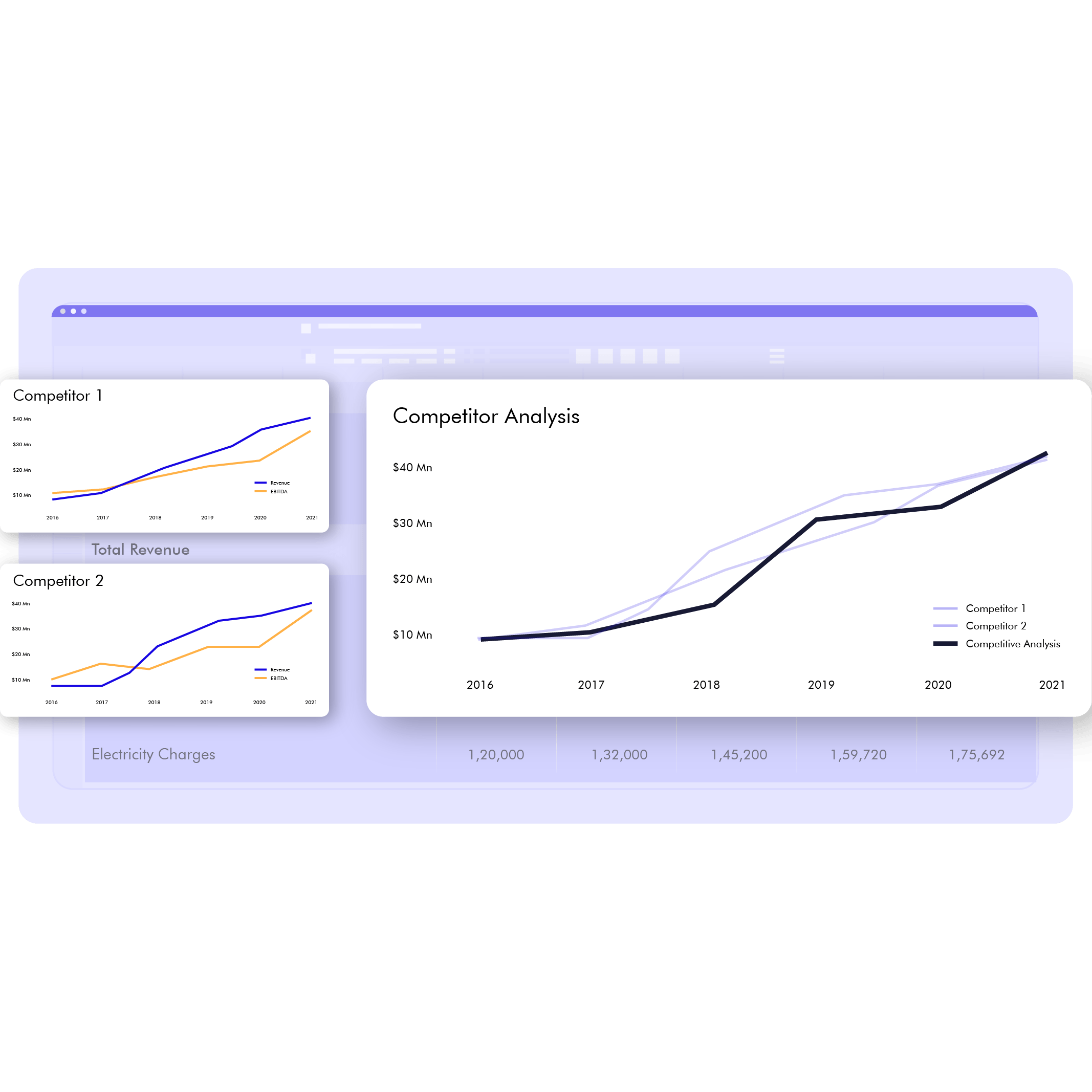

Competitor Benchmarking

Benchmarking the right way to Justify the funding requirement is with competitor benchmarking this helps investors understand the growth metrics, revenue potential, expense pattern, budget and more.

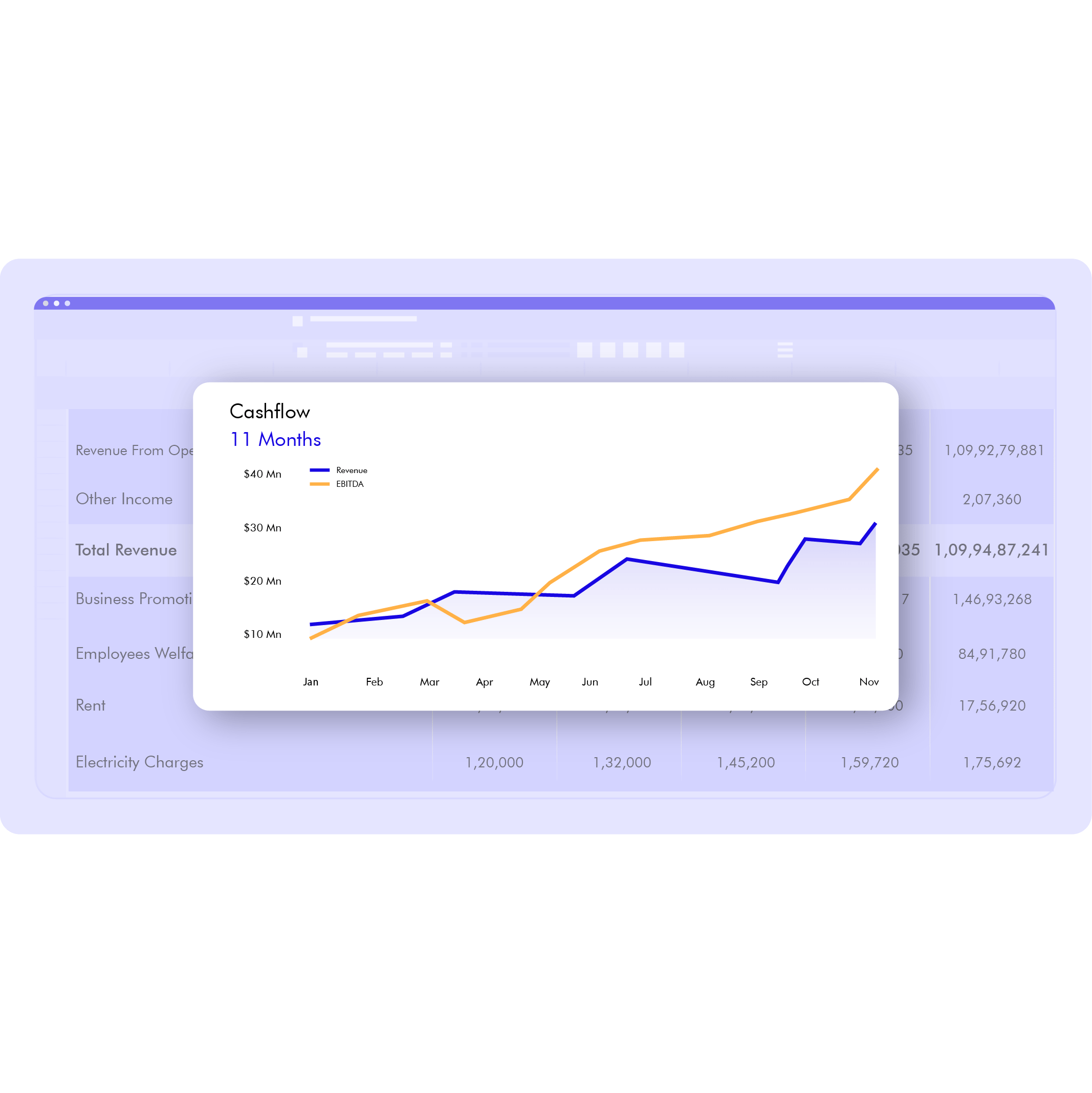

Scenario Planning

Investors expects founders to be prepared for all market scenarios. Our experts help you plan your cash flow and help investors evaluate founders capability and startup potentials

Cashflow

Scaalex takes your assumptions for a test drive and prepare for fund raising. With Scaalex experts you explore multiple business model compare and plan for fund raising.

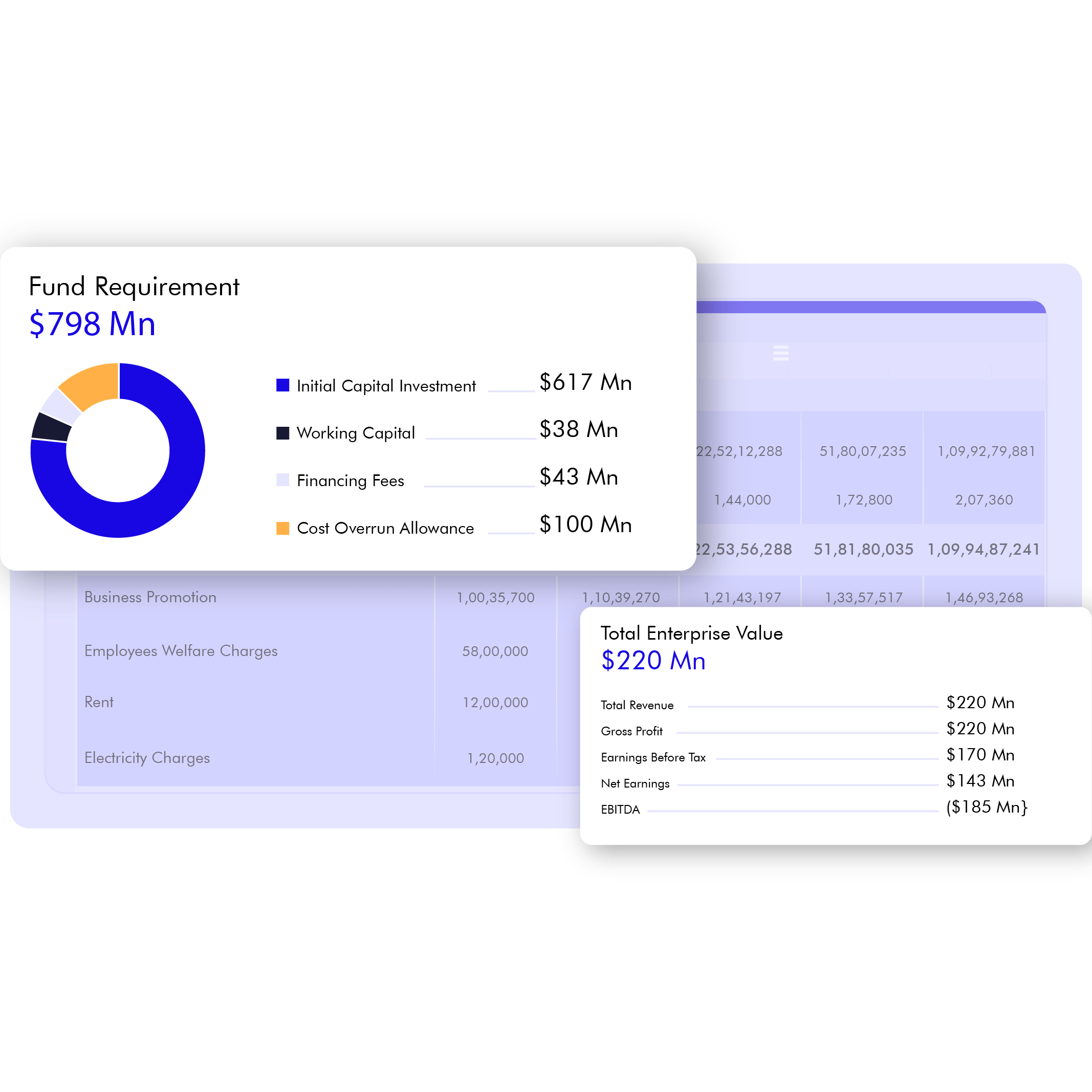

Funding Needs & Valuation

The funding requirements and valuation report helps you to approach investor. With out these reports investors will fail to understand the potential and investment opportunity with your startup

We've helped hundreds of startups raise their funds effectively

We were looking to create our financials and valuations. I’m highly satisfied with Quality Results, Professional Team and their efficiency to understand my startup. They were always there to help and I respect their hard work. Respect highly stick on to timelines.

The team comes with expertise and patience. We have been working with Scaalex from the day of Incorporation and they have proved to be the right growth partner to us. I strongly recommend the team.

Being a founder with innovative ideas, a lack of market metrics, financials, valuation reports, business plans and creating achievable business strategies was challenging. I found the Scaalex team with great patience to understand deep level processes and insightful analysis for my startup

I got connected through a strong reference and it has proved me worthy. Helped me to build our financial model and to raise funds from banks. The domain expertise and timely delivery is highly appreciated. Keep it up.

I sought help for financial modelling for my startup. They were able to understand my requirements better and deliver on time. I'm impressed with their project management and output. They did an excellent job!

I liked the way the scaalex did the articulation of financial document and made easy to understand for startup founders.