Our financial model capabilities

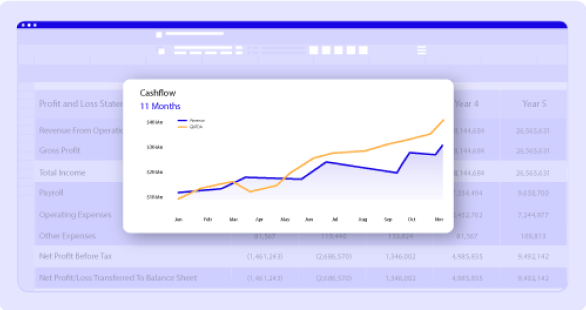

We forecast the future revenue and cash-flow using market research, competitor metrics and ratio analysis.

We deliver updated excel sheets with equations for easy understanding and iterations

Cashflow planning to estimate fundraising, valuation metrics, equity dilution and exit plans.

Our sheets can support "n" number of startup revenue models and equations to update.

Plan your KPIs and pricing metrics based on competition and cash flow planning.

We develop and validate IRR, NPV, DCF, WACC and more for due diligence and fundraising.

What is Financial Modelling?

A Financial Modelling is a research-driven report of a startups growth and revenue metrics. A solid financial modelling helps a startup track gross and net margin KPIs and forecast future performance based on critical metrics such as unit economics, market fit, competitor metrics and projected valuation. The Financial Model is a fundamental tool business and fundraising decisions for startup founders and small business owners.

Financial modelling services provide concise, data-driven reports that help businesses analyze growth, track key metrics, and make informed decisions based on projections and market insights. These services are essential tools for startups and small businesses seeking to optimize their financial performance and secure funding.

What is included in the Financial Model?

Our Financial Model includes a Comprehensive Competitor Analysis, In-depth Research, Forecasting and Projections, Scenario Analysis, Sensitivity Analysis, Financial Statement Preparation, Valuation & Investment Analysis, Customization & Adaptability.

Our Preparation Process

Our process works seamlessly - it starts with documentation and payments. Every project is assigned to a dedicated Project Manager for a seamless experience. In short - the project starts with a briefing call to understand the position of the company. Then we go back and understand the market and competitors and start evaluating the market. We then deliver a framework with relevant data and metrics to discuss. Then there will be 2-3 rounds of discussion to help you freeze the numbers.

Why work with ScaaleX

We bring proven experience in developing and facilitating startup fundraising, with a track record of delivering 250+ global projects and supporting fundraising mandates ranging from $500K to $150Mn. Our tailored solutions, backed by a team of financial experts and investment bankers, ensure that our analysis and investor-focused approach stand out in all our deliverables.

What is financial modeling, and why is it important for my startup?

What kind of financial modeling services do you offer?

Can you help me with financial projections and forecasting for my startup?

How do you factor in different scenarios and assumptions when creating a financial model?

Need to know more ?

Connect with us.

Scaalex brings fundraising insights to you, from profit & loss to cash flow planning. Build a robust financial model to make strategic fundraising decisions that impact your startup growth.