Why Do You NEED US

Identifying the potential risk associated with future investment

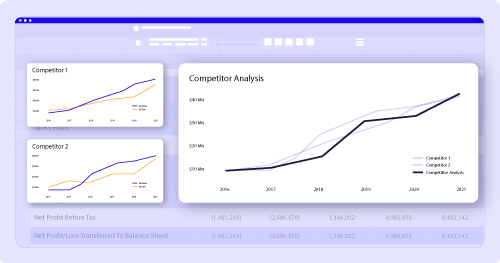

Analysis of the business structure, market, supplier and customers

Assessment of the company's strategy

Assessment of target company's financial statements, metrics, and projections of its future performance

Understanding the strategic fit between the company and the buyer

How do We help?

Due diligence looks into all aspects of an acquisition. The procedure is the same regardless of deal size, type, or level of risk.

It's necessary to comply with all the regulations that keep increasing. As we evaluate the goals of the project, you will gain knowledge of what requirements you need to match.

Our team of experts examines your financial and legal documents to ensure the transactions are performed successfully. Our analysts look for errors by running thorough risk analyses to spot issues and address them quickly.

Using data collected, our specialists determine whether a prospect is creditworthy or not. Information is processed to ensure that there are no potential risks involved.

A rigorous assessment of the risks due to internal factors is performed. Risks are identified and mitigated through thorough assessment and validation procedures

Frequently Asked Questions

What is due diligence, and why is it important for startups?

Due diligence is a comprehensive assessment conducted to evaluate the financial, legal, operational, and strategic aspects of a startup before entering into a transaction or partnership. It helps identify potential risks, uncover hidden issues, and validate key assumptions, ensuring informed decision-making and minimizing potential pitfalls.

What are the key areas covered during a due diligence process?

A typical due diligence process covers various areas, including financial analysis, legal compliance, market analysis, intellectual property assessment, operational evaluation, customer and supplier contracts, human resources review, and competitive landscape analysis. Each area is scrutinized to uncover potential risks and opportunities.

How long does a due diligence process usually take?

The duration of a due diligence process depends on various factors, such as the complexity of the startup, the depth of analysis required, and the availability of information. Typically, the process can range from a few weeks to a couple of months. However, scaalex strives to streamline the process without compromising the quality of the evaluation.

How can due diligence benefit my startup?

Due diligence offers several benefits to startups. It helps identify potential red flags or weaknesses, allowing you to address them proactively. It provides a clear understanding of your startup's market position, competitive advantages, and growth potential. Additionally, due diligence enhances credibility in potential partnerships, investments, or acquisitions, attracting investors and enabling informed decision-making.

Need to know more ?

Connect with us.

Scaalex brings fundraising insights to you, from profit & loss to cash flow planning. Build a robust financial model to make strategic fundraising decisions that impact your startup growth.