Our Investment Banking Capabilities

At Scaalex, we provide comprehensive Investment Banking support for startups, SMEs and emerging growth companies — helping you raise capital, structure deals, and navigate complex transactions with confidence.

Our Investment Banking Capabilities

Equity Fundraising

(Pre-Seed to IPO)

Investor outreach, pitch strategy, deal documentation, negotiation support.

Debt Fundraising

Working capital, venture debt, revenue-based financing, NBFC/Banks.

M&A Advisory

Buy-side and sell-side assistance, target screening, valuation, negotiation support.

Transaction Advisory

Business restructuring, investor reporting, transaction readiness, financial strategy.

Due Diligence Preparation

Full financial, business and compliance review to get you “investor-ready.”

Valuation & Financial Modelling

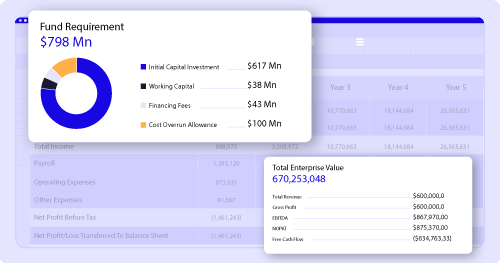

Investor-grade models, scenario analysis and valuation reports for transaction clarity.

Need to know more ?

Connect with us.

Scaalex brings fundraising insights to you, from profit & loss to cash flow planning. Build a robust financial model to make strategic fundraising decisions that impact your startup growth.