Our Due Diligence Capabilities

We perform detailed historical financial audits: revenue, costs, margins, working capital and cash flows — uncovering past performance to inform future decisions.

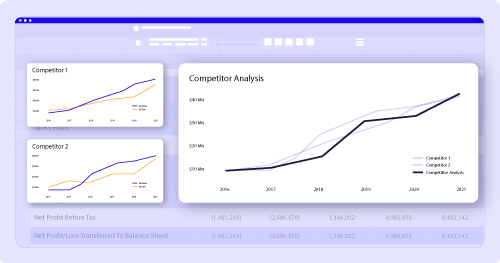

We assess forecast robustness and assumptions: validating your projections against market data, competitor benchmarks, unit economics and scenario modelling.

We review capital structure, funding history and shareholder dilution: ensuring clarity on ownership, obligations and the implications for exit strategy.

We map risk-factors and compliance exposures: financial and operational risks, regulatory or contractual contingencies, and their impact on transaction value.

We deliver transaction-ready deliverables: clear summary reports, editable finance models, sensitivity analyses and due-diligence packs tailored for investors or acquirers.

What is Financial Due Diligence?

What’s included in our Due Diligence engagement?

Historical financial statement review (P&L, Balance Sheet, Cash Flow)

• Quality of earnings analysis and abnormal items review

• Working capital, cash conversion cycle and capital‐expenditure reviews

• Existing liabilities, commitments, off-balance sheet exposures

• Forecast validation: Revenue model, cost structure, pricing metrics

• Scenario & sensitivity modelling: upside, base, downside

• Ownership structure, capital raise history & dilution modelling

• Business model & competitive benchmarking

• Risk assessment: key assumptions, regulatory/compliance, contractual risks

• Final deliverables: Executive summary, detailed findings, updated model, dashboards & presentation-ready pack

Our Preparation Process

1. Kick-off briefing: Understand your company (or target), transaction context, and key risks.

2. Document & data collection: Historical financials, projections, cap table, contracts.

3. Analysis phase: We dig into the numbers, validate assumptions, build scenario models.

4. Review & iterate: We present findings, discuss anomalies, refine assumptions (2-3 loops).

5. Delivery: Final report and model, ready for investors/acquirers.

What is due diligence, and why is it important for startups?

What are the key areas covered during a due diligence process?

How long does a due diligence process usually take?

How can due diligence benefit my startup?

Need to know more ?

Connect with us.

Scaalex brings fundraising insights to you, from profit & loss to cash flow planning. Build a robust financial model to make strategic fundraising decisions that impact your startup growth.