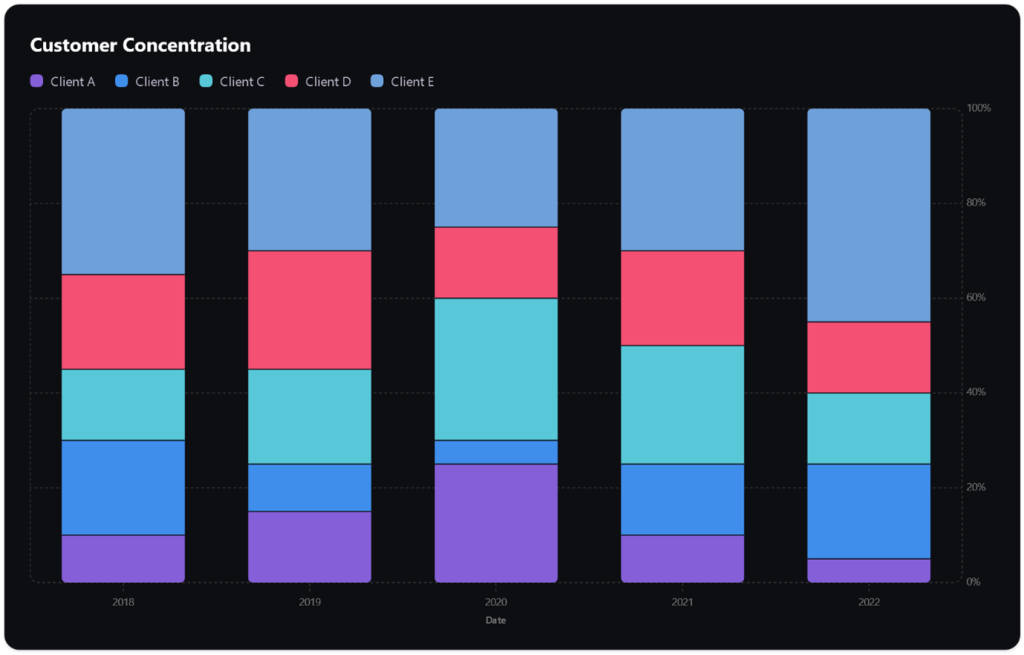

What is Customer Concentration?

Customer concentration, also known as client concentration, is a measure of how a business’s revenue is distributed across its customer base. It refers to the degree to which a company’s revenue is dependent on a single customer or a small group of customers. For instance, if more than 10% of a company’s revenue comes from a single client or 25% comes from a group of five of its most prominent clients, the company is considered to have a high customer concentration.

How To Measure Customer Concentration?

To measure customer concentration, one needs to identify the amount of revenue that the business earned from a particular client during a specific year. This amount is then divided by the business’s total revenue for that year. The resulting number is multiplied by 100 to complete the calculation. The final figure represents the client concentration level expressed as a percentage.

What is a High Customer Concentration?

High customer concentration occurs when a single or a small group of customers accounts for a significant portion of a business’s revenue.

Specifically, if a single customer accounts for 10% or more of the revenue, or if the largest four to five customers account for 25% or more of the revenue, the business is considered to have a high customer concentration. This situation can make the business’s revenue highly sensitive and potentially unstable.

Risks Associated With High Client Concentration?

There are several risks associated with high client concentration. One of the primary risks is the potential loss of a significant portion of revenue if a major customer is lost. This could jeopardize the business’s financial stability and even its survival. Additionally, it can negatively impact a business’s ability to secure loans with favorable interest rates due to perceived instability.

How To Avoid or Reduce High Customer Concentration?

To avoid or reduce high customer concentration, businesses can employ various strategies. One of the most effective strategies is to diversify and increase the customer base. This can be achieved through various means such as expanding into new markets, offering new products or services, or forming partnerships with other companies.

Another strategy is to enter into long-term supply agreements (LTSAs) with customers, which can provide a more stable and predictable revenue stream.

Diversify Your Customer Base

Here are a few techniques to broaden your customer reach:

- Networking: Establishing a network of industry contacts can be an invaluable effort for a small enterprise. Forming relationships with other businesses can lead to more customers through client referrals and open up new opportunities.

- Search Engine Optimization: An effective SEO strategy enhances your Business’s visibility to potential customers and improves your website’s ranking on Google or other search engines.

- Leveraging Social Media: Social media platforms like Twitter or LinkedIn can be a crucial digital asset for your enterprise as they enable you to connect with both current and potential customers. Instead of utilizing all available platforms, conduct some research to identify the most suitable one for your enterprise.

- Product or Service Diversification: If your enterprise offers a niche product or service targeting a relatively small market, attracting new customers could be challenging. If it’s feasible to broaden your enterprise’s offerings by introducing a slightly different but related product or service, it could be a viable strategy to increase your customer base.

Conclusion

In conclusion, understanding and managing customer concentration is crucial for the financial health and stability of a business. High client concentration can pose significant risks, but these can be mitigated through strategic planning and diversification efforts.

Related blogs: Key startup financial metrics, Startup Cashflow

FAQ

Some famous examples include companies that faced financial troubles when their major customers reduced orders or switched suppliers. For instance, when BlackBerry lost its dominance, its reliance on a few major carriers resulted in a significant revenue decline.

If more than 10% of a company’s revenue comes from a single client or 25% comes from a group of five of its most prominent clients, the company is considered to have a high client concentration.

It depends on the industry and the nature of the business. However, a lower client concentration is generally considered healthier, as it signifies less reliance on a small group of customers for revenue.

Yes, certain industries such as technology, manufacturing, and retail can be more prone to customer concentration due to the nature of their business models and relationships.

Supporters of significant client concentration highlight the potential to cultivate enduring relationships with a select number of prominent customers. This approach allows for customized contractual arrangements tailored to each client’s specific requirements.